Kota mati dalam film sering digambarkan sebagai tempat yang mencekam, tanpa penghuni, dan reruntuhan puing bangunan ada dimana-mana. Tapi tahukah kamu, kalau kota tak berpenghuni seperti itu ada di dunia nyata.

Ada beberapa faktor yang membuat sebuah kota bisa ditinggalkan oleh penduduknya hingga menjadi kota tak berpenghuni seperti per*ng besar, bencana alam (gempa, banjir, dan lainnya), wabah penyakit, dan lain sebagainya.

Walaupun sudah lama ditinggalkan, namun ada beberapa kota tak berpenghuni yang justru memperlihat sisi keindahan yang luar biasa karena terlalu ditinggalkan. Lantas, seperti apa saja kota mati tersebut? Berikut ulasannya.

25+ Kota Mati di Dunia! Dua di Antaranya Ada di Indonesia!!

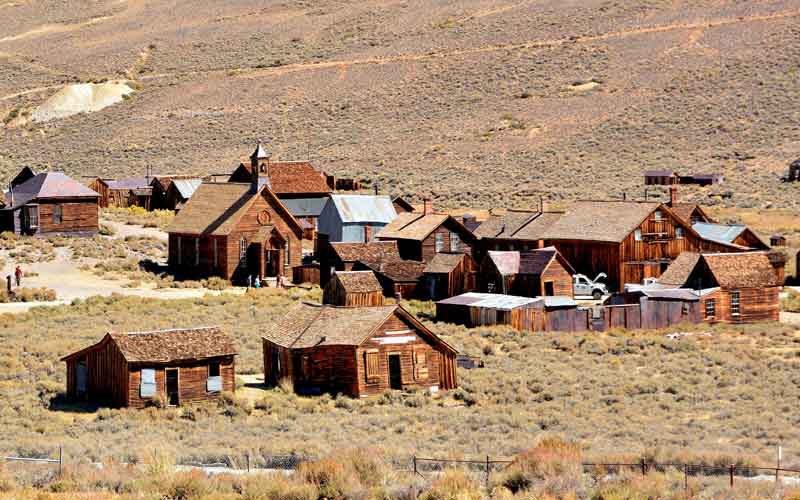

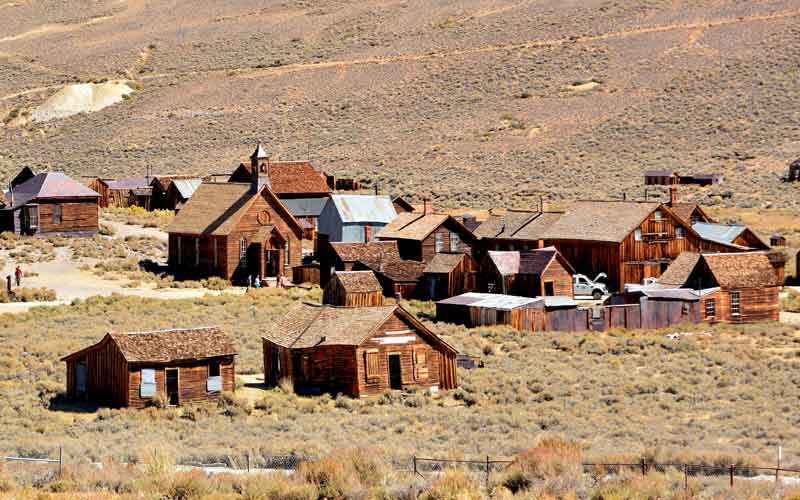

#1. Bodie di California

|

| Bodie di California |

Pada tahun 1859 silam, Kota Bodie di California ini sangat terkenal dengan pertambangan emasnya yang sangat melimpah. Dimana pada waktu itu, kota ini dihuni kurang lebih 8.500 orang dengan sekitar 2.000 bangunan.

Namun pada tahun 1881, cadangan tambang emas di kota ini mulai menipis, ditambah pada tahun 1932 terjadi kebakaran besar yang menghanguskan hampir semua bangunannya. Tidak lama setelahnya, kota ini mulai ditinggalkan secara besar-besaran hingga sekarang menjadi kota mati.

BACA JUGA: 20+ Tempat Terindah di Dunia Seperti Surga Yang Jatuh Ke Bumi!!

#2. Kolmanskop di Namibia

|

| Kolmanskop di Namibia |

Kota Kolmanskop di Namibia ini sangat terkenal dengan pertambangan berlian di masa lalu. Sehingga pada tahun 1908 silam, orang-orang mulai berbondong-bondong mendatangi kota ini untuk mencari keberuntungan.

Namun setelah per*ng dunia pertama berakhir, harga berlian turun drastis, sehingga penduduk di kota ini pun mulai kesulitan untuk memenuhi kebutuhan hidupnya sehari-hari. Puncaknya pada tahun 50-an penduduknya mulai meninggalkan kota ini secara masal sehingga kota ini menjadi kota mati.

#3. Goldfield di Arizona

|

| Goldfield di Arizona |

Dimasa lalu, Goldfield adalah salah satu kota yang cukup dikenal di Arizona, Amerika Serikat. Dan hampir sama dengan kota tak berpenghuni lainnya, kota ini juga terkenal dengan pertambangannya di tahun 1890-an. Tapi, pada tahun 1920-an, kota ini sudah tidak ada penghuninya lagi.

#4. Kennecott di Alaska

|

| Kennecott di Alaska |

Kurang lebih sama dengan kota-kota sebelumnya, Kota Kennecott di Alaska ini juga terkenal karena adanya tambang tembaga pada tahun 1940-an. Namun setelah cadangan tembaganya mulai habis, kota ini ditinggalakn penduduknya begitu saja.

#5. Sanzhi di Taiwan

|

| Sanzhi di Taiwan |

Kalau Kota Sanzhi di Taiwan ini menjadi kota tidak berpenghuni karena sebelum pembangunan selesai, pemiliknya sudah bangkrut duluan, sehingga bangunan-bangunan megah tersebut dibiarkan begitu saja.

Pada awalnya, kota ini direncanakan sebagai tempat peristirahatan bagi lansia-lansia kaya. Uniknya, bangunan-bangunan di Kota Sanzhi di Taiwan ini mirip seperti ufo.

#6. Animas Forks di Colorado

|

| Animas Forks di Colorado |

Pada tahun 1870-an, kota yang berada di pegunungan San Juan di Colorado ini sangat terkenal dengan pertambangan emas dan perak, namun kota ini mulai ditinggalkan penduduknya setelah cadangan emas dan peraknya mulai habis pada tahun 1920-an.

#7. Craco di Italia

|

| Craco di Italia |

Kota Craco di Italia ini sudah ada sejak abad ke-8, dan populasinya juga cukup ramai. Namun setelah mengalami beberapa kali gemba bumi pada awal abad ke-20, membuat para penduduknya meninggalkan kota ini secara masal.

Puncaknya terjadi pada tahun 1991 silam, kota ini mengalami bencana tanah longsor, sehingga pada akhirnya kota ini menjadi kota tak berpenghuni sampai sekarang.

#8. Rhyolite di Nevada

|

| Rhyolite di Nevada |

Kota Rhyolite di Nevada ini dijuluki sebagai ” kota emas “ pada tahun 1904 karena adanya tambang emas di kota ini. Kemudian pada tahun 1906 mulai banyak orang membangun pemukiman di kota ini. Namun pada tahun 1920-an kota ini tiba-tiba ditinggalkan penduduknya.

#9. Centralia di Pennsylvania

|

| Centralia di Pennsylvania |

Di bawah tanah Kota Centralia di Pennsylvania ini terdapat api dari tambang batubara yang terus menyala sampai sekarang sejak tahun 1962 silam. Pada awalnya, para penduduknya tidak mau meninggalkan kota ini karena hal tersebut tidak berbahaya.

Namun pada akhirnya, para penduduknya mau tidak mau harus meninggalkan kota ini. Hingga akhirnya kota ini hanya menyisakan beberapa orang saja, dan sebuah bangunan gereja yang masih melanjutkan pelayanannya.

#10. Wittenoom di Australia

|

| Wittenoom di Australia |

Dimasa lalu, Kota Wittenoom adalah sebuah kota kecil di Australia yang terkenal dengan tambang asbesnya. Namun, seluruh kawasan kota ini ditutup pemerintah setelah banyak warganya yang sakit-sakitan akibat kualitas udara yang buruk.

Sebelum kota ini ditutup oleh pemerintah hingga menjadi kota mati, Kota Wittenoom merupakan satu-satunya pemasok asbes biru di Negara Australia selama kurun waktu 10 tahun, yaitu dari tahun 1950-an hingga tahun 1960-an.

#11. Pulau Hashima di Jepang

|

| Pulau Hashima di Jepang |

Dimasa lalu, di Pulau Hashima ini terdapat sebuah kota yang merupakan salah satu kota terpadat di dunia pada saat itu. Dimana diketahui, antara tahun 1800-an hingga tahun 1974 terdapat banyak bangunan pemukiman pekerja tambang batubara bawah laut.

Namun setelah tahun 1974, tambang di pulau ini ditutup. Setelah itu, semua penduduknya pun mulai meninggalkan pulau ini secara masal. Kini, Pulau Hashima di Jepang menjadi salah satu pulau tak berpenghuni di dunia.

#12. Ross Island di India

|

| Ross Island di India |

Pada saat masih di jajah oleh bangsa Inggris, pulau ini menjadi markas pusat hukum di India yang kemudian diikuti dengan berkembangnya infrastruktur-nya. Namun pada tahun 1941 terjadi gempa hebat yang membuat para penduduknya memutuskan meninggalkan paulau ini.

#13. Pripyat di Ukraina

|

| Pripyat di Ukraina |

Kota Pripyat di Ukraina ini dulunya merupakan sebuah kota dengan populasi penduduk yang mencapai 50.000 jiwa, namun kota ini langsung menjadi kota tak berpenghuni karena ditinggalkan penduduknya akibat ledakan nuklir Chernobyl pada tahun 1986.

#14. San Juan Parangaricutiro di Meksiko

|

| San Juan Parangaricutiro di Meksiko |

Kota San Juan Parangaricutiro di Meksiko ini dibangun di sebelah Gunung Paricutin. Kemudian Gunung Paricutin meletus pada tahun 1942, dimana letusannya tersebut juga ikut menghancurkan kota San Juan Parangaricutiro. Kini, kota ini sudah tidak berpenghuni lagi.

#15. Humberstone di Chili

|

| Humberstone di Chili |

Kota Humberstone ini dulunya merupakan pusat pertambangan nitrat yang sangat berkembang di Chili. Namun kota ini mengalami kebangkrutan setelah para ilmuwan berhasil menemukan cara untuk mensitetis amonia.

#16. Villa Epecuén di Argentina

|

| Villa Epecuén di Argentina |

Kota Villa Epecuén di Argentina ini dulunya adalah sebuah resort yang megah sebelum dihancurkan oleh banjir besar pada tahun 1985. Sampai sampai saat ini, kota ini tidak pernah di pulih lagi dan menjadi salah satu kota mati di dunia.

#17. Dhanushkodi di India

|

| Dhanushkodi di India |

Selain kota di Ross Island, ada satu lagi kota tak berpenghuni di India yaitu Kota Dhanushkodi. Kota ini ditinggalkan penduduknya setelah diterjang angin topan pada tahun 1964. Walaupun sudah porak-poranda, namun kota ini masih dianggap keramat oleh umat hindu di India.

#18. Salton Riviera di California

|

| Salton Riviera di California |

Kota Salton Riviera di California ini dulunya sering dikunjungi oleh para wisatawan yang memiliki ketertarikan dengan pantai yang indah. Hanya saja, karena airnya tiba-tiba menjadi sangat asin, sehingga banyak ikan mati.

Dampaknya, tempat ini menjadi bau yang berasal dari bangkai-bangkai ikan mati tersebut. Dan pada akhirnya penduduk kota ini pun memutuskan pindah ke tempat lain.

#19. Kayakoy di Turki

|

| Kayakoy di Turki |

Kota Kayakoy di Turki ini dibangun pada tahun 1700-an dan merupakan rumah bersama bagi Muslim Anatolia dan Kristen Ortodoks Yunani. Tapi situasinya memanas setelah perang dunia pertama, dan perang yunani dan turki antara tahun 1919-1922.

Karena kondisi inilah dibuat kesepakatan pada tahun 1923 yang intinya adalah Kota Kayakoy harus ditinggalkan oleh para penduduknya sebagai bentuk perdamaian politik pada saat itu.

#20. Holland Island di Chesapeake Bay

|

| Holland Island di Chesapeake Bay |

Dulunya, pulau Holland adalah pulau dengan populasi terbesar di Chesapeake Bay. Tapi, karena pulau Holland terbentuk dari tanah liat bercampur lumpur, kelama-lamaan terkikis dan tenggalam pada tahun 2010 silam.

#21. Deception Island di Antartika

|

| Deception Island di Antartika |

Sebelum menjadi kota tak berpenghuni, kota ini adalah pusat penangkapan ikan paus yang sempat mengalami kemajuan cukup pesat. Tapi, karena letusan gunung api yang terjadi pada tahun 1969 silam membuat penduduknya terpaksa harus pindah.

#22. St. Thomas di Nevada

|

| St. Thomas di Nevada |

Kota St. Thomas di Nevada ini ditinggalkan penduduknya karena banjir besar yang diakibatkan oleh bendungan sungai Kolorado meluap, sehingga penduduknya secara massal mengungsi. Tapi, setelah banjir reda, mereka tidak mau kembali ke kota ini.

#23. St. Elmo di Colorado

|

| St. Elmo di Colorado |

Sama dengan kota Animas Forks, kota St. Elmo di Colorado juga merupakan daerah pertambangan emas dan perak, dimana pada tahun 1880-an, banyak orang memutuskan menetap disana. Tapi, akibat ditutupnya rel kereta api membuat kota ini akhirnya ditutup dan menjadi salah satu kota mati di dunia.

Kota mati di Indonesia

Ternyata Indonesia juga memiliki kota mati, setidaknya ada yang sudah diketahui yaitu Marina City di Batam dan Simacem. Dimana kedua kota tersebut sudah ditinggalkan penduduknya karena alasan tertentu. Simak ulasannya berikut ini,

#24. Marina City di Indonesia

|

| Marina City di Indonesia |

Dulu, kota ini adalah pusat perjudian di Batam, banyak warganya yang hidup makmur pada saat itu. Tapi, setelah adanya larangan perjudian dari pemerintah Indonesia, secara drastis, perekonomian kota ini lumpuh total. Akibatnya, banyak warganya yang meninggalkan kota ini ke kota lainnya.

#25. Simacem di Indonesia

|

| Simacem di Indonesia |

Kota mati di Indonesia selanjutnya yaitu Simacem yang ditinggalkan warganya karena dampak dari letusan gunung berapi, sehingga banyak rumah-rumah warga yang diselimuti oleh abu-abu vulkanik yang dianggap berbahaya bagi kesehatan.

Akhir Kata

Nah, itulah beberapa kota mati yang ada di dunia, dimana dua di antaranya ternyata ada di Indonesia. Walaupun sudah tidak berpenghuni lagi, tapi banyak orang yang menganggap kota tak berpenghuni ini masih menyimpan sisi keindahan. Baca juga daftar negara pecahan uni soviet.